Spanish Taxes, Simplified — by Experts Who Understand Expats

Living in Spain comes with tax obligations that are complex, confusing, and often overwhelming — especially if you’re new here. At Innolegals, our certified tax professionals provide end-to-end support for expats, ensuring you stay compliant, avoid penalties, and pay only what’s fair.

Who We Help

Residents (Living in Spain)

- Unsure if you qualify as a Spanish tax resident under the 183-day rule?

- Do you need to declare your worldwide income?

- Afraid of double taxation on income from your home country?

Residency status checks and tailored tax planning

Annual Income Tax (IRPF) declarations for expats

Application of Double Taxation Agreements (DTAs)

Guidance on the Beckham Law (Regime for Inbound Expats)

Advisory on wealth, property, and investment taxes

Non-Residents (Property Owners & Investors)

- You don't live in Spain but own property here. Do you still need to pay taxes?

- Unsure how Non-Resident Income Tax (IRNR) works?

- Worried about late filings and penalties?

Residency status checks and tailored tax planning

Filing IRNR (Modelo 210) for rental income, property sales, or ownership

Clarification on 19% vs. 24% tax rates (EU vs. non-EU residents)

Expense deductions where legally possible

Penalty-free filings and ongoing compliance reminders

Advisory on wealth, property, and investment taxes

Self-Employed (Autónomos)

- Quarterly VAT (IVA) and Income Tax (IRPF) filings are complex and time-consuming

- Not sure which expenses — home office, coworking, travel — are deductible?

- As a digital nomad, you might not work for Spanish companies — but you still need autónomo status to invoice your foreign clients and stay compliant while living in Spain

Autónomo registration (Modelo 036/037) — essential for digital nomads applying for Spanish residency

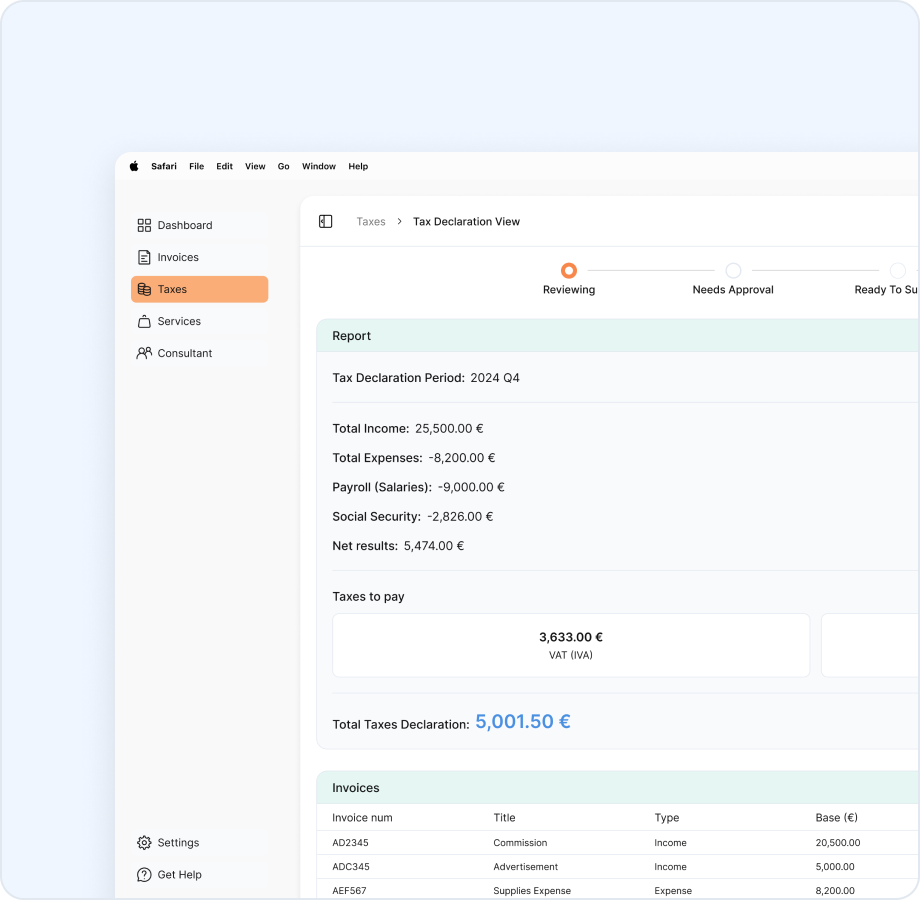

Quarterly filings: VAT (IVA), Income Tax (IRPF), and Social Security contributions

Expense optimization (equipment, coworking, travel, housing) to reduce your tax burden

Guidance on the Beckham Law (Regime for Inbound Expats)

Digital dashboard with compliance reminders and secure document upload

Guidance on transitioning from digital nomad visa to long-term resident tax solutions

Our Specialized Tax Services

Beyond the basics, we provide comprehensive expat-focused solutions:

Tax Registration

Modelo 036, Modelo 149 (Beckham Law), NIF applications

Beckham Law Setup

Get help registering under Beckham Law

Tax Return Filing

Modelo 100, Modelo 210

Company Setup

We handle SL formation and NIEs

Residency Tax Help

Clarify your fiscal status

Consultation

Talk to a Spanish tax expert

Why Choose InnoLegals

Built Exclusively for Expats

We make sure you're not overpaying — or under-complying.

Multilingual Human Support

You'll always understand your tax situation.

Tax Strategy, Not Just Form Filing

Digital Platform = Zero Paper Hassles

Integrated Immigration + Tax Advice

Tax advice that keeps you legally in Spain.

Recognized by Spain’s Tax Authorities, Trusted by Expats Worldwide

InnoLegals is authorized to work directly with Spain’s official tax authorities and professional associations.

This means your filings are not only prepared by experts — they are fully compliant, officially recognized, and trusted at the highest level.

Why Thousands Rely on Our Spanish Tax Experts

Certified Spanish tax lawyers & accountants

500+ expats supported across 25+ countries

Compliance guarantee — if our error causes a penalty, we cover it

GDPR-compliant, secure document handling

Recognized expertise in cross-border taxation

What Our Clients Say About Working With Us

Your Visa Got You Here. We’ll Make Sure Your Taxes Keep You Here.

From residents to non-residents to autónomos, InnoLegals is your trusted tax partner in Spain.

Subscribe

Make Your Move With Confidence

Get insider visa tips, important updates, and expert advice—delivered in simple English, no legal jargon.

You're all signed up!

Thanks for joining our newsletter. Soon, you'll start receiving helpful updates, tips, and insights—straight to your inbox.

Talk to the InnoLegals Team

Whether it’s a quick question or a complex legal issue, we’re ready to hear from you.

Thank you for reaching out!

We've received your message and our immigration specialist will contact you within 24 hours.